Tobacco and Alcoholic Product Levy (TAPL)

What is tobacco and alcohol product levy (TAPL)?

Tobacco and Alcoholic Product Levy (TAPL) is a newly introduced tax that is imposed on selling of tobacco and or alcoholic products at all stages of the business cycle in the country. This levy also applies on importation of these products into Lesotho by businesses and individuals (private shoppers).

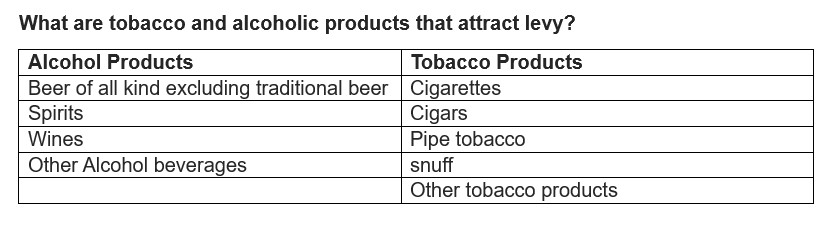

What are tobacco and alcoholic products that attract levy?

What are applicable TAPL Rates?

- Tobacco is charged at 20%

- Alcoholic products are charged at 10%

What is the effective date of TAPL rates above?

- The new rates above are effective from 1st April 2025.

Who is eligible to charge TAPL?

- Value added tax (VAT) registered persons (vendors) within the country.

- RSL border agencies staff upon the importation of these products into Lesotho.

How to register for TAPL?

Automatic registration will apply to already registered vendors of tobacco and alcoholic products. However, it is the responsibility of the person/business to register for both taxes once the VAT registration threshold of M2,000, 000.00 per annum is reached.

How is TAPL Charged?

Levy as is the case with VAT is charged on the fair market value of the products, not on the VAT inclusive price. On importation TAPL is charged on all other duties, charges and levies that are payable on importation of products into Lesotho. The charges may include (customs valuation + levies + customs duties + value of any services incidental to importation, e.g. freight/transport, insurance)

Levy is not charged on the exportation of tobacco and alcoholic products. VAT law stipulates zero rate on export of goods. TAPL Law does not provide for any other rate other than the 10% and 20% rates already mentioned. This means that a vendor, is not expected to account for, or submit a TAPL return form for exported products.

When to file TAPL return and pay TAPL due?

TAPL returns and payments are due on the 20th of the month following the tax period.

| Attachment | Size |

|---|---|

| Tobacco and Alcoholic Products Levy Regulations No.58 of 2025 (1).pdf (586.4 KB) | 586.4 KB |

| Guide on Tobacco & Alcoholic Products Levy (2).pdf (594.6 KB) | 594.6 KB |

| TOBACCO AND ALCOHOLIC PRODUCTS LEVY ACT NO.1 OF 2023 (1) (1).pdf (56.8 KB) | 56.8 KB |

| Guide on Tobacco & Alcoholic Products Levy- (1).pdf (530.27 KB) | 530.27 KB |